Accounting is considered to be the language of business. The number of globalized businesses in the world is vast and increasing, which emphasizes the importance of achieving a common accounting language. Accounting is predominantly known as the profession that analyzes the past, but because of globalization it is important to look into the future.

As a result, it is important to educate the accounting field on the standards of other countries. The IRSF was created by the International Accounting Standards board. The Financial Accounting Standards Board created the generally accepted accounting principles.

Accounting is predominantly known as the profession that analyzes the past and looks into the future. Globalization plays a huge role on accounting education. Thus it is more important to educate accountants on the standards of other countries, so that they are knowledgeable in their field because many businesses operate with countries across the world.

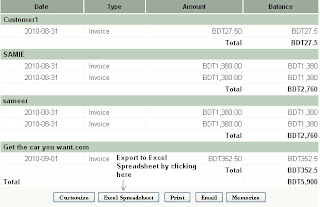

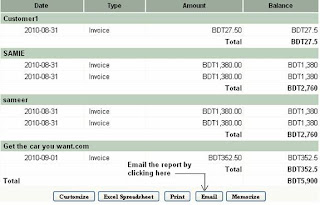

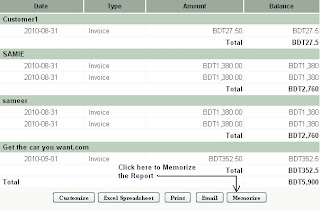

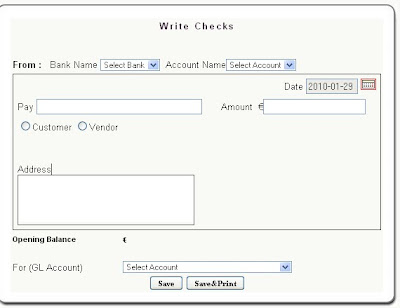

The accounting education is more important in such a way that the accountant becomes a part of the management and decision-making team, rather than just providing the financial information. Accounting in the future will require not only specific knowledge but also must also be able to change with the globalization. Accountants will need to be well prepared in computer skills, the ability to learn new software and new accounting rules.

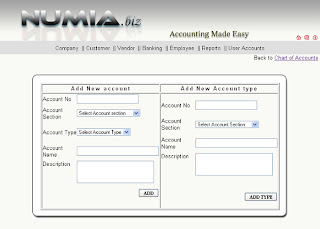

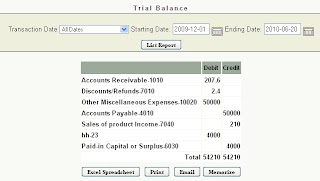

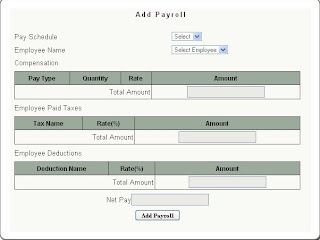

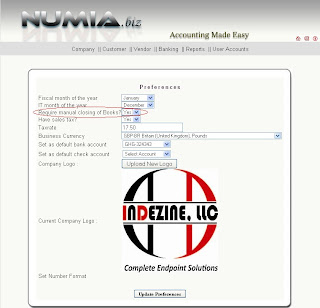

Realizing the importance of information technology most of the colleges and universities have added a new track called Accounting Information System. The Professional accountants employ extensively in the computer applications to perform their tasks such as email to communicate, Internet for search, and accounting software to record and analyze financial transactions for decision-making. Computerized accounting systems have now replaced manual accounting systems in most of the organizations.