The main objectives for preparing trial balance are

• To check arithmetic accuracy.

• To help in preparing Financial statements.

• Helps in locating errors.

• Helps in comparison

• Helps in making adjustments.

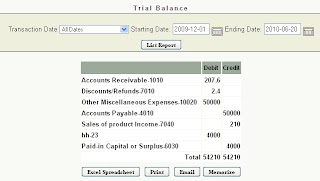

In Numia, Online accounting software, You can get the trial balance report easily, showing the debit and credit balances of each account in the chart of accounts. The screenshot for trial balance report in Numia is shown below:

The steps involved are as follows.

• Choose Reports-->Reports review-->Trial Balance.

• The report shows the credit and debit balances for each account.

• You can restrict the report details by selecting dates.

• You can either print the report using print option or export the report to Microsoft excel sheet. You can also able to email it or memorize.

Hi!

ReplyDeleteNice you guys are doing here.Information for trial balance given without any questions needed again.Bravo!I have been a user of Numia.biz for some time now.Please I wish to know on how to input data for previous years.That is back dating(putting information of a different financial year).Please kindly direct me on that cos I chose numia for its simplicity.Email me to :bayangiman@yahoo.com

Thanks

Excellent sharing Thanks for share i am sure its must help me. thanks for doing this.

ReplyDeleteonline business software

In this blog we getting information about trial balance where we make debit and credit entries.Thanks for sharing it.

ReplyDeleteERP Cloud