Closing book or closing entry should be done at the end of every fiscal year. After the closing entries have been prepared, the temporary accounts will reflect in retained earnings and an intermediate account called income summary is created from which revenues and balances are transferred to retained earnings account(capital). Dividend or withdrawal accounts should be closed to capital.

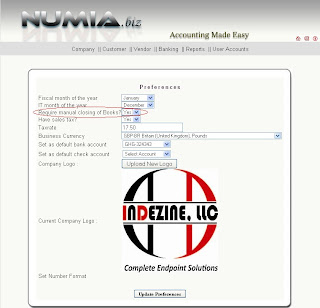

Numia, provides you easier way for closing your book, having 2 choices either you can close manually or automatically. You can manually close just by selecting yes in the “Require manual closing of books” option highlighted in the above screen shot. And it closes automatically if you choose no.

Following are the steps for closing of books :

- Select Company --> click preferences.

- Fill the details.

- Select Require manual closing of books as ‘YES’ if you want to close your entry manually.

- Default option will be set to 'NO' which automatically closes the account and adds new entry for the next financial year based on the fiscal month.

No comments:

Post a Comment